How Cpa Okc can Save You Time, Stress, and Money.

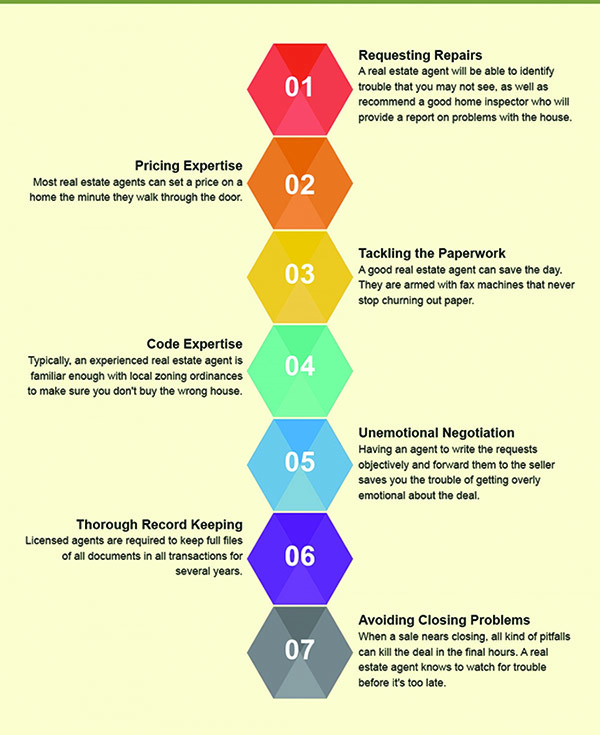

With so lots of accounting firms out there, how do you pick the best one? Here are four vital steps to take when picking an accounting company: 1. Think about the costs charged by the accounting company. You don't desire to overpay for accounting services, however you also do not want to choose a company that is so inexpensive that they cut corners on quality.

Not known Details About Cpa Okc

Make sure the accounting firm has experience in your industry. Ask the company about their with companies in your industry and see if they have any customized understanding or certifications that would be advantageous to you.

Ask about the company's approach on taxes., and you'll desire to make sure that your accounting firm is on the very same page.

Have a look at the firm's referrals. Similar to you would with any other business decision, you'll want to make sure you're selecting a credible and qualified company. Ask the company for references from previous clients and provide a call to find out how pleased they were with the services they received.

The Facts About Business Consulting Okc Revealed

But by following these four actions, you can be positive that you're selecting a certified and that will help your organization be successful - https://www.cybo.com/US-biz/p-accounting-llc#google_vignette. Think about the charges charged by the accounting firm - Important Steps in Selecting the Right Accounting Company When you're searching for an accounting firm, you want to discover one that is a good fit for your company

Here are some important steps to take in choosing the ideal accounting company: 1. What services do you need? When you have a great understanding of your needs, you can start looking for companies that specialize in those locations.

An Unbiased View of Okc Tax Credits

When you have a list of prospective companies, its time to do your research. This will offer you a good sense of their reputation and whether or notthey are a great fit for your business.

Meet with representatives from prospective firms. Once you have actually narrowed down your list, its time to start fulfilling with representatives from the firms you're thinking about.

Fascination About Real Estate Bookkeeping Okc

Make your choice. Choose the firm that you feel most comfortable with and that you think will best.

Consult with agents from potential companies - Critical Actions in Choosing the Right Accounting Firm It is necessary to get recommendations from each prospective accounting company. This will help you get a feel for the firm's level of experience and client service. Be sure to ask each reference the same set of questions so you can compare their responses.

Some Known Details About Accounting Okc

There's no requirement to lose your time with a firm that doesn't have. Choosing an accounting company is an important step in guaranteeing the success of your business. There are many this decision, and it is necessary to pick a firm that will be an excellent needs. https://pblc.me/pub/9adde76a964bda. Here are some essential factors to think about when picking an accounting firm: 1.

Make sure to choose a company that offers the services that you need, such as bookkeeping, tax preparation, and financial planning. 2. Experience Another important factor to consider when selecting an accounting firm is their experience. Select a company that has experience working with businesses in your industry. This will guarantee that they understand your special needs and can supply the finest possible service.

The Single Strategy To Use For Okc Tax Deductions

Place The place of the accounting firm is likewise an important consideration. Fees When selecting an accounting firm, it is likewise essential to consider their fees.

Make your decision and pick an accounting firm - Critical Steps in Picking the Right Accounting Firm.

:max_bytes(150000):strip_icc()/Accounting-FINAL-e01e0f2d93264a989c19357a99d7bffd.jpg)